Access Historic Court Documents via Epiq Systems website. Includes pre May 2010 information and on-going legal matters.

Settlement Of Claims

Below you will find information about several post-Chapter 11 items including:

-

Settlement of Secured Claims

-

Unsecured Claim Distributions

-

Expected Tax Treatment of Class A Shares in Satisfaction of Claims

-

Impact of Chapter 11 Proceeding on Former Lyondell Chemical Company and Millennium Chemical Company Shareholders

Settlement of Secured Claims

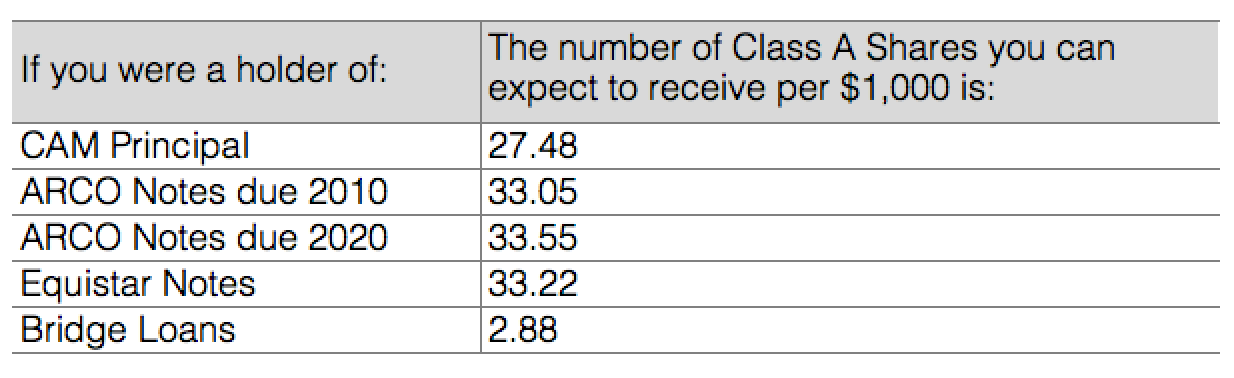

The table below summarizes the estimated distributions that will be received by holders of various instruments following the Company’s emergence from Chapter 11 protection on April 30, 2010.

Computershare, our transfer agent, can be reached at 1-877-456-7920 .

LyondellBasell’s claims hotline can be reached at 1-888-369-6609 or via email at lyondellteam@alixpartners.com.

Unsecured Claim Distributions

General Unsecured Claims

-

Per the Third Amended and Restated Joint Plan of Reorganization (the “Plan”) for Lyondell Chemical Company and its related debtor affiliates (collectively, the “Debtors”) that was confirmed by the United States Bankruptcy Court for the Southern District of New York on April 23, 2010 and became effective on April 30, 2010, the general unsecured claims against Obligor Debtors as defined in the Plan will share pro-rata in $450 million of settlement consideration ($300 million in cash and $150 million in stock) from the committee litigation

-

General unsecured claimants with allowed unsecured claims will receive a 15.4% recovery in the initial distribution in some form of cash and/or stock

-

$99.4 million dollars and 2.8 million Class A shares (each Class A share valued at approximately $17.61 per share) of the settlement consideration were transferred to the creditor representative as the reserve for unresolved and disputed general unsecured claims against Obligor Debtors

-

The timing and amount of potential subsequent distributions has not been determined.

-

Questions regarding the amounts of cash and stock disbursed to individual claimants should be addressed to LyondellBasell’s claims hotline which can be reached at 1-800-414-9605 or via email at LyondellBasell@AlixPartners.com.

Millennium Note Claims

-

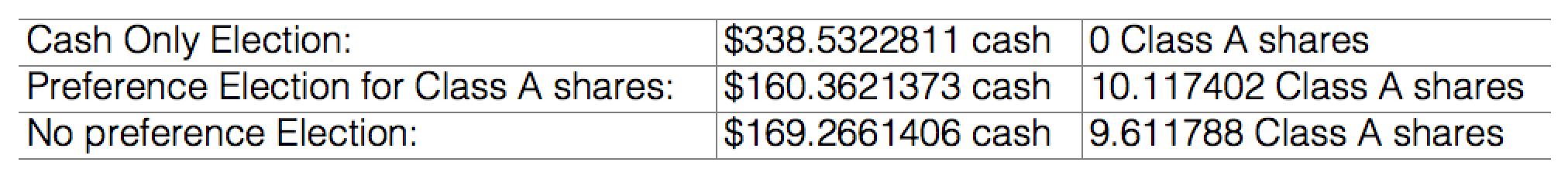

Per the executed settlement agreement relating to the committee litigation, the Millennium Note claims were allocated their pro-rata allocation of $42.5 million cash and $42.5 million of Class A shares (2,425,290 shares) in the initial distribution. Pro-rata allocation to note holders (per $1000 principal amount outstanding) was:

Questions regarding the amounts of cash and stock disbursed to individual bond holders, as well as any future distributions, should be addressed to the indenture trustee or its counsel at: (i) The Corporate Trust Office of Law Debenture Trust Company of New York, 400 Madison Avenue, 4th Floor, New York, NY, 10017 (Attn: Robert L. Bice II, Senior Vice President); Tel: 212-750-6474 or (ii) Dewey & LeBouef LLP, 180 N. Stetson Ave., Suite 3700, Chicago, IL 60601; Tel: 312-794-8052 Fax: 312-794-8100 Email:mkhambati@dl.com(Attn: Moshin N. Khambati, Esq.).

2015 Note Claims

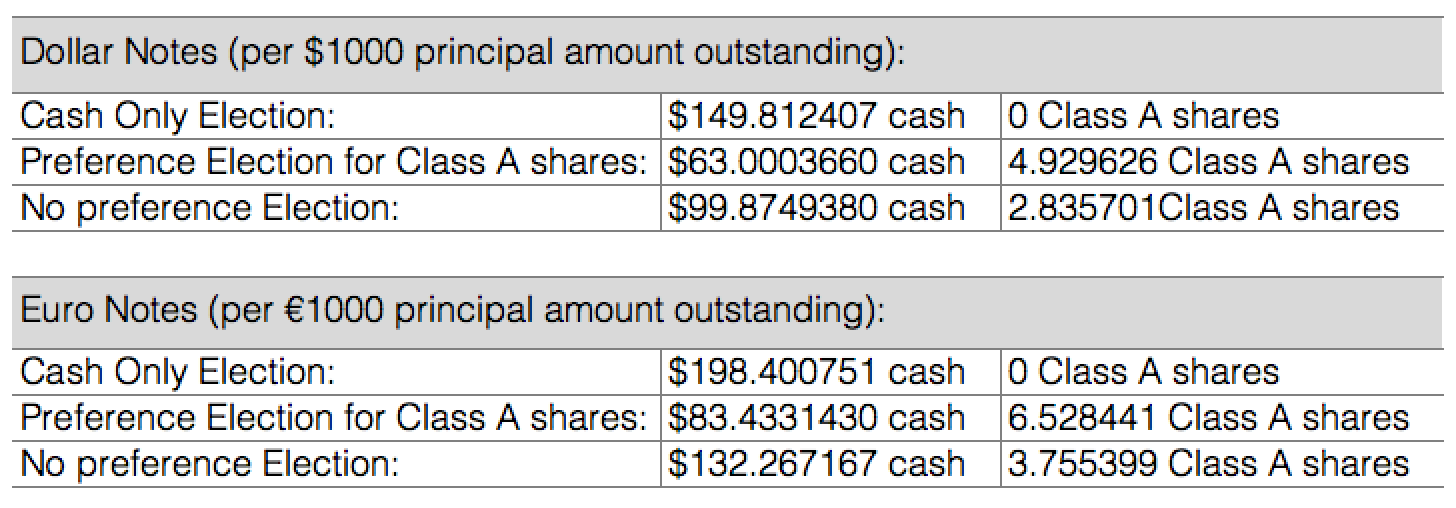

Per the executed settlement agreement relating to the committee litigation, the 2015 Note claims received their pro-rata allocation of the $450 million of settlement consideration (less the $15 million cash that was paid (allocated) to the Millennium Note Claims), consisting of $117.5 million of cash and 4,326,070 Class A shares, in the initial distribution. Pro-rata allocation to note holders was:

Questions regarding the amounts of cash and stock disbursed to individual bond holders, as well as any future distributions, should be addressed to the indenture trustee at: Steve Cimalore (Vice

President) at Wilmington Trust Company, Rodney Square North, 1100 North Market Street, Wilmington, Delaware 19890-1600; Tel: (302) 636-6058

Expected Tax Treatment of Class A Shares in Satisfaction of Claims against U.S. Debtors

The company described the expected tax treatment of the bankruptcy reorganization transaction in its 3rd amended disclosure statement to its plan.

The tax discussion begins at page 173. The following is an excerpt from page 175 with reference to allowed claims against U.S. obligor debtors (“U.S. Claims”) other than “Allowed Senior Secured Facility Claims” against foreign obligors:

(ii) Holders of U.S. Claims . . .

The U.S. Debtors believe that the satisfaction of U.S. Claims in exchange for Class A Shares received directly from the relevant U.S. Debtor generally should be a taxable transaction for U.S. federal income tax purposes. Except as otherwise provided below, holders of the applicable U.S. Claims generally should recognize gain or loss upon the discharge of their U.S. Claims equal to the difference between (1) the amount realized by the holder in satisfaction of such U.S. Claims, and (2) the holder’s adjusted tax basis in such U.S. Claims. The holder’s amount realized with respect to such transaction generally should equal the fair market value of the property received by the holder. . . .The holder’s tax basis in property received in the exchange generally should equal the fair market value of such property, and the holding period for such property generally should begin on the date following its receipt.

Accordingly, the company expects that the distribution of stock and other rights with respect to such U.S. Claims will be treated as a taxable event to the holders of such claims, but this position is not binding on the IRS.

Impact of Chapter 11 Proceeding on Former Lyondell Chemical Company and Millennium Chemical Company Shareholders

Overview

We are posting this note in response to a number of inquiries we have received from former Lyondell Chemical Company or Millennium Chemical Company shareholders. Unfortunately, as explained below, former shareholders who did not file timely claims in the recent reorganization do not have any basis for recovery. The background for this conclusion is outlined below.

Background

Lyondell Chemical Company was acquired on December 20, 2007 in a $48 per share all cash transaction by an affiliate of Access Industries, a privately held company. Prior to its acquisition, in 2004 Lyondell Chemical Company acquired Millennium Chemical Company in a merger transaction.

In January 6, 2009, Lyondell Chemical Company, Millennium Chemical Company and most of their subsidiaries filed chapter 11 reorganization proceedings in the U.S. Bankruptcy Court for the Southern District of New York. Former shareholders of Lyondell or Millennium who previously had not received merger consideration, or unclaimed dividends, etc. all became potential unsecured creditors of Lyondell or Millennium as of the chapter 11 filings on January 6, 2009.

The deadline for filing proofs of claim in the chapter 11 proceedings was June 30, 2009, the claims bar date. Any potential creditors of Lyondell or Millennium, including former shareholders, who failed to file a proof of claim before the claims bar date are precluded, as a matter of law, from obtaining a recovery as an unsecured creditor in the chapter 11 proceeding.

The Plan of Reorganization for Lyondell and Millennium became effective on April 30, 2010. Claims against Lyondell or Millennium that were not raised timely during the chapter 11 proceedings have been discharged and barred.

6% Special Convertible Stock (“Special Stock”) of LyondellBasell Advanced Polymers Inc. (formerly known as A. Schulman, Inc.)

Frequently asked questions for 6.00% cumulative perpetual convertible special stock of LyondellBasell Advanced Polymers Inc. (formerly known as A. Schulman, Inc.) are available here.